stat946F18/Autoregressive Convolutional Neural Networks for Asynchronous Time Series

This page is a summary of the paper "Autoregressive Convolutional Neural Networks for Asynchronous Time Series" by Mikołaj Binkowski, Gautier Marti, Philippe Donnat. It was published at ICML in 2018.

Introduction

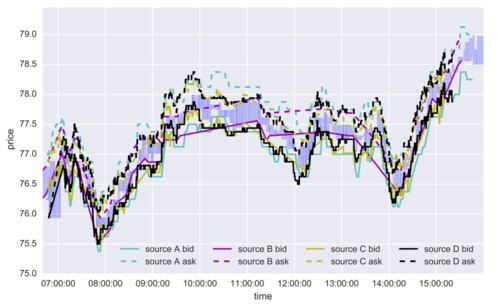

In this paper, the authors proposed a deep convolutional network architecture called Significance-Offset Convolutional Neural Network, for regression of multivariate asynchronous time series. The model is inspired by standard autoregressive(AR) models and gating systems used in recurrent neural networks, and is evaluated on such datasets: a hedge fund proprietary dataset of over 2 million quotes for a credit derivative index, an artificially generated noisy autoregressive series and UCI household electricity consumption dataset. This paper focused on time series with multivariate and noisy signals, especially the financial data. Financial time series are challenging to predict due to their low signal-to-noise ratio and heavy-tailed distributions. For example, same signal (e.g. price of stock) is obtained from different sources (e.g. financial news, investment bank, financial analyst etc.) in asynchronous moment of time. Each source has different different bias and noise.(Figure 1) The investment bank with more clients can update their information more precisely than the investment bank with fewer clients, then the significance of each past observations may depend on other factors that changes in time. Therefore, the traditional econometric models such as AR, VAR, VARMA[1] might not be sufficient. However, their relatively good performance could allow us to combine such linear econometric models with deep neural networks that can learn highly nonlinear relationships.

The time series forecasting problem can be expressed as a conditional probability distribution below, we focused on modeling the predictors of future values of time series given their past:

The predictability of financial dataset still remains an open problem and is discussed in various publications. ([2])

Related Work

Time series forecasting

From recent proceedings in main machine learning venues i.e. ICML, NIPS, AISTATS, UAI, we can notice that time series are often forecast using Gaussian processes[3,4], especially for irregularly sampled time series[5]. Though still largely independent, combined models have started to appear, for example, the Gaussian Copula Process Volatility model[6]. For this paper, the authors use coupling AR models and neural networks to achieve such combined models.

Although deep neural networks have been applied into many fields and produced satisfactory results, there still are little literature on deep learning for time series forecasting. More recently, the papers include Sirignano (2016)[7] that used 4-layer perceptrons in modeling price change distributions in Limit Order Books, and Borovykh et al. (2017)[8] who applied more recent WaveNet architecture to several short univariate and bivariate time-series (including financial ones). Heaton et al. (2016)[9] claimed to use autoencoders with a single hidden layer to compress multivariate financial data. Neil et al. (2016)[10] presented augmentation of LSTM architecture suitable for asynchronous series, which stimulates learning dependencies of different frequencies through time gate.

In this paper, the authors examine the capabilities of several architectures (CNN, residual network, multi-layer LSTM, and phase LSTM) on AR-like artificial asynchronous and noisy time series, household electricity consumption dataset, and on real financial data from the credit default swap market with some inefficiencies.

Gating and weighting mechanisms

Gating mechanisms for neural networks has ability to overcome the problem of vanishing gradient, and can be expressed as [math]\displaystyle{ f(x)=c(x) \otimes \sigma(x) }[/math], where [math]\displaystyle{ f }[/math] is the output function, [math]\displaystyle{ c }[/math] is a "candidate output" (a nonlinear function of [math]\displaystyle{ x }[/math]), [math]\displaystyle{ \otimes }[/math] is an element-wise matrix product, and [math]\displaystyle{ \sigma : \mathbb{R} \rightarrow [0,1] }[/math] is a sigmoid nonlinearity that controls the amount of output passed to the next layer. This composition of functions may lead to popular recurrent architecture such as LSTM and GRU[11].

The idea of the gating system is aimed to weight outputs of the intermediate layers within neural networks, and is most closely related to softmax gating used in MuFuRu(Multi-Function Recurrent Unit)[12], i.e. [math]\displaystyle{ f(x) = \sum_{l=1}^L p^l(x) \otimes f^l(x), p(x)=softmax(\widehat{p}(x)), }[/math], where [math]\displaystyle{ (f^l)_{l=1}^L }[/math]are candidate outputs(composition operators in MuFuRu), [math]\displaystyle{ (\widehat{p}^l)_{l=1}^L }[/math]are linear functions of inputs.

This idea is also successfully used in attention networks[13] such as image captioning and machine translation. In this paper, the method is similar as this. The difference is that modelling the functions as multi-layer CNNs. Another difference is that not using recurrent layers, which can enable the network to remember the parts of the sentence/image already translated/described.

Motivation

There are mainly five motivations they stated in the paper:

- The forecasting problem in this paper has done almost independently by econometrics and machine learning communities. Unlike in machine learning, research in econometrics are more likely to explain variables rather than improving out-of-sample prediction power. These models tend to 'over-fit' on financial time series, their parameters are unstable and have poor performance on out-of-sample prediction.

- Although Gaussian processes provide useful theoretical framework that is able to handle asynchronous data, they often follow heavy-tailed distribution for financial datasets.

- Predictions of autoregressive time series may involve highly nonlinear functions if sampled irregularly. For AR time series with higher order and have more past observations, the expectation of it [math]\displaystyle{ \mathbb{E}[X(t)|{X(t-m), m=1,...,M}] }[/math] may involve more complicated functions that in general may not allow closed-form expression.

- In practice, the dimensions of multivariate time series are often observed separately and asynchronously, such series at fixed frequency may lead to lose information or enlarge the dataset, which is shown in Figure 2(a). Therefore, the core of proposed architecture SOCNN represents separate dimensions as a single one with dimension and duration indicators as additional features(Figure 2(b)).

- Given a series of pairs of consecutive input values and corresponding durations, [math]\displaystyle{ x_n = (X(t_n),t_n-t_{n-1}) }[/math]. One may expect that LSTM may memorize the input values in each step and weight them at the output according to the durations, but this approach may lead to imbalance between the needs for memory and for linearity. The weights that are assigned to the memorized observations potentially require several layers of nonlinearity to be computed properly, while past observations might just need to be memorized as they are.

Model Architecture

Suppose there's a multivariate time series [math]\displaystyle{ (x_n)_{n=0}^{\infty} \subset \mathbb{R}^d }[/math], we want to predict the conditional future values of a subset of elements of [math]\displaystyle{ x_n }[/math]

where [math]\displaystyle{ I=\{i_1,i_2,...i_{d_I}\} \subset \{1,2,...,d\} }[/math] is a subset of features of [math]\displaystyle{ x_n }[/math]. Let [math]\displaystyle{ \textbf{x}_n^{-M} = (x_{n-m})_{m=1}^M }[/math]. The estimator of [math]\displaystyle{ y_n }[/math] can be expressed as:

This is summation of the columns of the matrix in bracket, where

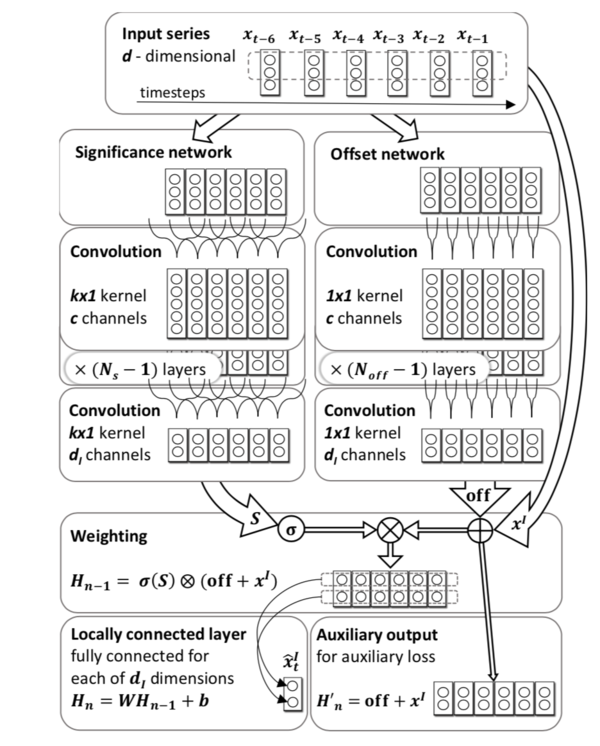

- [math]\displaystyle{ F,S : \mathbb{R}^{d \times M} \rightarrow \mathbb{R}^{d_I \times M} }[/math] are neural networks. S is a fully convolutional network which is composed of convolutional layers only. [math]\displaystyle{ F }[/math] is in the form of

[math]\displaystyle{ F(\textbf{x}_n^{-M}) = W \otimes [off(x_{n-m}) + x_{n-m}^I)]_{m=1}^M }[/math] where [math]\displaystyle{ W \in \mathbb{R}^{d_I \times M} }[/math] and [math]\displaystyle{ off: \mathbb{R}^d \rightarrow \mathbb{R}^{d_I} }[/math] is a multilayer perceptron.

- [math]\displaystyle{ \sigma }[/math] is a normalized activation function independent at each row, i.e. [math]\displaystyle{ \sigma ((a_1^T,...,a_{d_I}^T)^T)=(\sigma(a_1)^T,...\sigma(a_{d_I})^T)^T }[/math]

- [math]\displaystyle{ \otimes }[/math] is element-wise matrix multiplication.

- [math]\displaystyle{ A.,_m }[/math] denotes the m-th column of a matrix A, and [math]\displaystyle{ \sum_{m=1}^M A.,_m=A(1,1,...,1)^T }[/math].

Since [math]\displaystyle{ \sum_{m=1}^M W.,_m=W(1,1,...,1)^T }[/math] and [math]\displaystyle{ \sum_{m=1}^M S.,_m=S(1,1,...,1)^T }[/math], we can express [math]\displaystyle{ \hat{y}_n }[/math] as:

This is the proposed network, Significance-Offset Convolutional Neural Network, [math]\displaystyle{ off }[/math] and [math]\displaystyle{ S }[/math] in the equation are corresponding to Offset and Significance in the name respectively. Figure 3 shows the scheme of network.

The form of [math]\displaystyle{ \hat{y}_n }[/math] forced to separate the temporal dependence (obtained in weights [math]\displaystyle{ W_m }[/math]). S is determined by its filters which capture local dependencies and are independent of the relative position in time, the predictors [math]\displaystyle{ off(x_{n-m}) }[/math] are completely independent of position in time. An adjusted single regressor for the target variable is provided by each past observation through the offset network. Since in asynchronous sampling procedure, consecutive values of x come from different signals, and might be heterogenous, therefore adjustment of offset network is important.In addition, significance network provides data-dependent weight for each regressor and sums them up in an autoregressive manner.

Relation to asynchronous data

One common problem of time series is that durations are varying between consecutive observations, the paper states two ways to solve this problem

- Data preprocessing: aligning the observations at some fixed frequency e.g. duplicating and interpolating observations as shown in Figure 2(a). However, as mentioned in the figure, this approach will tend to loss of information and enlarge the size of the dataset and model complexity.

- Add additional features: Treating duration or time of the observations as additional features, it is the core of SOCNN, which is shown in Figure 2(b).

Loss function

The output of the offset network is series of separate predictors of changes between corresponding observations [math]\displaystyle{ x_{n-m}^I }[/math] and the target value[math]\displaystyle{ y_n }[/math], this is the reason why we use auxiliary loss function, which equals to mean squared error of such intermediate predictions:

The total loss for the sample [math]\displaystyle{ \textbf{x}_n^{-M},y_n) }[/math] is then given by:

where [math]\displaystyle{ \widehat{y}_n }[/math] was mentioned before, [math]\displaystyle{ \alpha \geq 0 }[/math] is a constant.

Experiments

The paper evaluated SOCNN architecture on three datasets: artificial generated datasets, household electric power consumption dataset, and the financial dataset of bid/ask quotes sent by several market participants active in the credit derivatives market. Comparing its performance with simple CNN, single and multiplayer LSTM and 25-layer ResNet. The code and datasets are available here

Datasets

Artificial data: They generated 4 artificial series, [math]\displaystyle{ X_{K \times N} }[/math], where [math]\displaystyle{ K \in \{16,64\} }[/math]. Therefore there is a synchronous and an asynchronous series for each K value.

Electricity data: This UCI dataset contains 7 different features excluding date and time. The features include global active power, global reactive power, voltage, global intensity, sub-metering 1, sub-metering 2 and sub-metering 3, recorded every minute for 47 months. The data has been altered so that one observation contains only one value of 7 features, while durations between consecutive observations are ranged from 1 to 7 minutes. The goal is to predict all 7 features for the next time step.

Non-anonymous quotes: The dataset contains 2.1 million quotes from 28 different sources from different market participants such as analysts, banks etc. Each quote is characterized by 31 features: the offered price, 28 indicators of the quoting source, the direction indicator (the quote refers to either a buy or a sell offer) and duration from the previous quote. For each source and direction we want to predict the next quoted price from this given source and direction considering the last 60 quotes.

Training details

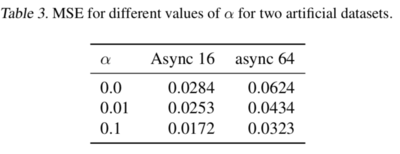

They applied grid search on some hyperparameters in order to get the significance of its components. The hyperparameters include the offset sub-network's depth and the auxiliary weight [math]\displaystyle{ \alpha }[/math]. For offset sub-network's depth, they use 1, 10,1 for artificial, electricity and quotes dataset respectively; and they compared the values of [math]\displaystyle{ \alpha }[/math] in {0,0.1,0.01}.

They chose LeakyReLU as activation function for all networks:

They use the same number of layers, same stride and similar kernel size structure in CNN. In each trained CNN, they applied max pooling with the pool size of 2 every 2 convolutional layers.

Table 1 presents the configuration of network hyperparameters used in comparison

Network Training

The training and validation data were sampled randomly from the first 80% of timesteps in each series, with ratio 3 to 1. The remaining 20% of data was used as a test set.

All models were trained using Adam optimizer, because the authors found that its rate of convergence was much faster than standard Stochastic Gradient Descent in early tests.

They used a batch size of 128 for artificial and electricity data, and 256 for quotes dataset, and applied batch normalization in between each convolution and the following activation.

At the beginning of each epoch, the training samples were randomly sampled. To prevent overfitting, they applied dropout and early stopping.

Weights were initialized using the normalized uniform procedure proposed by Glorot & Bengio (2010).[14]

The authors carried out the experiments on Tensorflow and Keras and used different GPU to optimize the model for different datasets.

Results

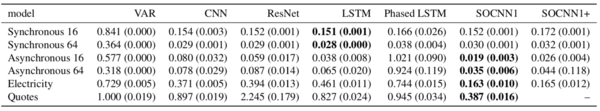

Table 2 shows all results performed from all datasets.

We can see that SOCNN outperforms in all asynchronous artificial, electricity and quotes datasets. For synchronous data, LSTM might be slightly better, but SOCNN almost has the same results with LSTM. Phased LSTM and ResNet have performed really bad on artificial asynchronous dataset and quotes dataset respectively. Notice that having more than one layer of offset network would have negative impact on results. Also, the higher weights of auxiliary loss([math]\displaystyle{ \alpha }[/math]considerably improved the test error on asynchronous dataset, see Table 3. However, for other datasets, its impact was negligible.

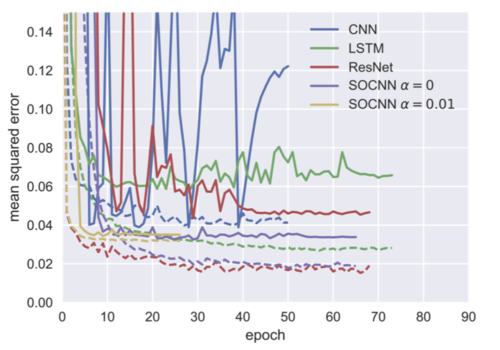

In general, SOCNN has significantly lower variance of the test and validation errors, especially in the early stage of the training process and for quotes dataset. This effect can be seen in the learning curves for Asynchronous 64 artificial dataset presented in Figure 5.

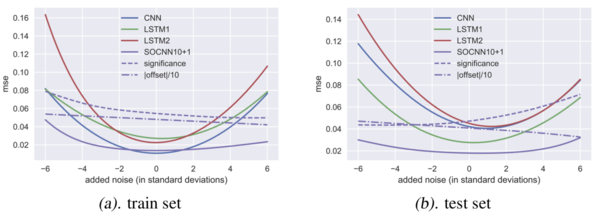

Finally, we want to test the robustness of the proposed model SOCNN, adding noise terms to asynchronous 16 dataset and check how these networks perform. The result is shown in Figure 6.

From Figure 6, the purple line and green line seems staying at the same position in training and testing process. SOCNN and single-layer LSTM are most robust compared to other networks, and least prone to overfitting.

Conclusion and Discussion

In this paper, the authors have proposed a new architecture called Significance-Offset Convolutional Neural Network, which combines AR-like weighting mechanism and convolutional neural network. This new architecture is designed for high-noise asynchronous time series, and achieves outperformance in forecasting several asynchronous time series compared to popular convolutional and recurrent networks.

The SOCNN can be extended further by adding intermediate weighting layers of the same type in the network structure. Another possible extension but needs further empirical studies is that we consider not just [math]\displaystyle{ 1 \times 1 }[/math] convolutional kernels on the offset sub-network. Also, this new architecture might be tested on other real-life datasets with relevant characteristics in the future, especially on econometric datasets.

Critiques

- The paper is most likely an application paper, and the proposed new architecture shows improved performance over baselines in the asynchronous time series.

- The quote data cannot be reached, only two datasets available.

- The 'Significance' network was described as critical to the model in paper, but they did not show how the performance of SOCNN with respect to the significance network.

- The transform of the original data to asynchronous data is not clear.

- The experiments on the main application are not reproducible because the data is proprietary.

Reference

[1] Hamilton, J. D. Time series analysis, volume 2. Princeton university press Princeton, 1994.

[2] Fama, E. F. Efficient capital markets: A review of theory and empirical work. The journal of Finance, 25(2):383–417, 1970.

[3] Petelin, D., Sˇindela ́ˇr, J., Pˇrikryl, J., and Kocijan, J. Financial modeling using gaussian process models. In Intelligent Data Acquisition and Advanced Computing Systems (IDAACS), 2011 IEEE 6th International Conference on, volume 2, pp. 672–677. IEEE, 2011.

[4] Tobar, F., Bui, T. D., and Turner, R. E. Learning stationary time series using gaussian processes with nonparametric kernels. In Advances in Neural Information Processing Systems, pp. 3501–3509, 2015.

[5] Hwang, Y., Tong, A., and Choi, J. Automatic construction of nonparametric relational regression models for multiple time series. In Proceedings of the 33rd International Conference on Machine Learning, 2016.

[6] Wilson, A. and Ghahramani, Z. Copula processes. In Advances in Neural Information Processing Systems, pp. 2460–2468, 2010.

[7] Sirignano, J. Extended abstract: Neural networks for limit order books, February 2016.

[8] Borovykh, A., Bohte, S., and Oosterlee, C. W. Condi- tional time series forecasting with convolutional neural networks, March 2017.

[9] Heaton, J. B., Polson, N. G., and Witte, J. H. Deep learn- ing in finance, February 2016.

[10] Neil, D., Pfeiffer, M., and Liu, S.-C. Phased lstm: Acceler- ating recurrent network training for long or event-based sequences. In Advances In Neural Information Process- ing Systems, pp. 3882–3890, 2016.

[11] Chung, J., Gulcehre, C., Cho, K., and Bengio, Y. Em- pirical evaluation of gated recurrent neural networks on sequence modeling, December 2014.

[12] Weissenborn, D. and Rockta ̈schel, T. MuFuRU: The Multi-Function recurrent unit, June 2016.

[13] Cho, K., Courville, A., and Bengio, Y. Describing multi- media content using attention-based Encoder–Decoder networks. IEEE Transactions on Multimedia, 17(11): 1875–1886, July 2015. ISSN 1520-9210.

[14] Glorot, X. and Bengio, Y. Understanding the dif- ficulty of training deep feedforward neural net- works. In In Proceedings of the International Con- ference on Artificial Intelligence and Statistics (AIS- TATSaˆ10). Society for Artificial Intelligence and Statistics, 2010.